Purchased a call for SPY 303, November 29th and a Put for SPY 293, same expiration.

Wednesday, October 23, 2019

Tuesday, October 8, 2019

Habit vs incentive

Ask a generic economist about the importance of a significant down payment for the housing market and they will reply with something about homeowners needing skin in the game so they don't bail at the first sign of trouble, and/or as a protection for the lender. This ought to have gone up in smoke during the financial crisis as many of the defaults and write downs came from homes with large down payments and well documented incomes. The primary tool of the large down payment is as a selection mechanism, and the slashing away at that mechanism was a major factor in the run up in prices.

The basic principle is simple, if you can save a significant sum of money then you are a much better risk for a loan than someone who doesn't. Home ownership via a mortgage comes with a double whammy, first you have structured regular payments for the mortgage, insurance and property taxes, then you have lump sum costs for repairs. A new roof, leaky pipes, broken windows, some large some small but persistent and sometimes lumpy. In short once you buy the house and commit to the recurring costs and dump your savings into the down payment you need to start saving again to handle these costs. This is where habit comes in, who is more likely to be able to maintain the house (ie the collateral), the one who saved 20% of the purchase price or the one who didn't? The answer is obvious.

Rising home prices didn't break the truism, but it did muddy the waters a lot. Having a 20% down payment could still have been due to a high savings rate, but it also could have been due to luck. If you bought a $100,000 house with 20% down early in the 2000s and home prices pushed its 'value' up 50% over the next few years then you could sell your house and have ~$70,000 available for your next down payment which would qualify you for a $350,000 loan (obviously your income might not) on the next one. Or you might have borrowed against that 50k in new equity and purchased a second house as a rental/vacation home/speculative asset. This is a very different situation than a person who bought a house, and then over several years saved up another down payment worth of cash. In both cases there is an incentive to keep the 2nd house with the down payment, but in one case you have a buyer who clearly was living below their means for several years and another case where it is unclear if they were or weren't.

During the financial crisis one of the largest segments for defaults was second homes purchased with normal down payments, which I believe was largely caused by the rise in home prices distorting the signal that a down payment usually brings.

The basic principle is simple, if you can save a significant sum of money then you are a much better risk for a loan than someone who doesn't. Home ownership via a mortgage comes with a double whammy, first you have structured regular payments for the mortgage, insurance and property taxes, then you have lump sum costs for repairs. A new roof, leaky pipes, broken windows, some large some small but persistent and sometimes lumpy. In short once you buy the house and commit to the recurring costs and dump your savings into the down payment you need to start saving again to handle these costs. This is where habit comes in, who is more likely to be able to maintain the house (ie the collateral), the one who saved 20% of the purchase price or the one who didn't? The answer is obvious.

Rising home prices didn't break the truism, but it did muddy the waters a lot. Having a 20% down payment could still have been due to a high savings rate, but it also could have been due to luck. If you bought a $100,000 house with 20% down early in the 2000s and home prices pushed its 'value' up 50% over the next few years then you could sell your house and have ~$70,000 available for your next down payment which would qualify you for a $350,000 loan (obviously your income might not) on the next one. Or you might have borrowed against that 50k in new equity and purchased a second house as a rental/vacation home/speculative asset. This is a very different situation than a person who bought a house, and then over several years saved up another down payment worth of cash. In both cases there is an incentive to keep the 2nd house with the down payment, but in one case you have a buyer who clearly was living below their means for several years and another case where it is unclear if they were or weren't.

During the financial crisis one of the largest segments for defaults was second homes purchased with normal down payments, which I believe was largely caused by the rise in home prices distorting the signal that a down payment usually brings.

Monday, September 23, 2019

Liquidity something

The big news from this past week was the Federal Reserve's sudden re-entrance into the overnight repo market, and adding liquidity. First question is was this a demand spike or a shortfall of supply?

No real demand spike, but a persistent decline in excess reserves has been decreasing the available supply.

Supply is also short in another sense

It seems unlikely that there is no maximum level of debt for a country, be it government, private or combined. Obviously it would be shifting based on factors such as interest rates but conceptually it is hard to argue that debt to gdp ratios can go up indefinitely, and it is likely an empirical answer you will get.

So here we are, a major financial crisis that started with massive debt levels and 10 years later those levels are roughly the same. We have now a strong policy of government stimulus in the face of recessions, with 2008 starting with a little remembered 110 billion dollar stimulus before a recession was officially recognized which came 7 months after the Fed started an easing cycle. Who is going to get hit this time if debt is increased?

To maintain the current level of total debt there will have to be a reduction to offset any government stimulus. The price rise you see above should be viewed even more skeptically than the one up until 2007 because it is on lower volume. Below is existing home sales (had to change sources)

Plus new home sales

We are looking at significantly lower volume, significantly less dollar value to gdp for mortgages in a larger country (in real prices the peak isn't as high as the previous peak though).

If this next recession is significant, with significant additional government debt I would expect home sales volume to die, and when volume dies volatility explodes.

No real demand spike, but a persistent decline in excess reserves has been decreasing the available supply.

It seems unlikely that there is no maximum level of debt for a country, be it government, private or combined. Obviously it would be shifting based on factors such as interest rates but conceptually it is hard to argue that debt to gdp ratios can go up indefinitely, and it is likely an empirical answer you will get.

So here we are, a major financial crisis that started with massive debt levels and 10 years later those levels are roughly the same. We have now a strong policy of government stimulus in the face of recessions, with 2008 starting with a little remembered 110 billion dollar stimulus before a recession was officially recognized which came 7 months after the Fed started an easing cycle. Who is going to get hit this time if debt is increased?

To maintain the current level of total debt there will have to be a reduction to offset any government stimulus. The price rise you see above should be viewed even more skeptically than the one up until 2007 because it is on lower volume. Below is existing home sales (had to change sources)

Plus new home sales

We are looking at significantly lower volume, significantly less dollar value to gdp for mortgages in a larger country (in real prices the peak isn't as high as the previous peak though).

If this next recession is significant, with significant additional government debt I would expect home sales volume to die, and when volume dies volatility explodes.

Thursday, August 29, 2019

Closed all shorts

Closed all shorts at significant losses. Currently anticipating markets to rise for next 6 months, considering going long.

Monday, August 5, 2019

perspective

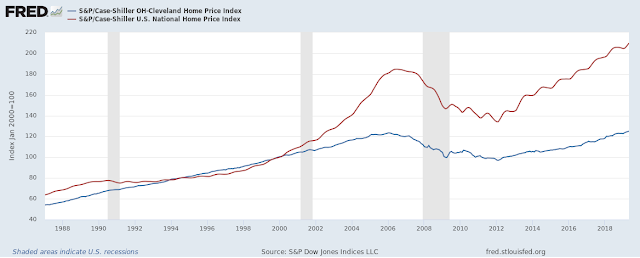

Some people describe the housing bubble of the early 2000s as being isolated to a few major cities, their outsized effect being what drove the events that unfolded. Smaller cities, such as Cleveland Ohio, had much smaller run ups, and smaller busts. As usual this is a matter of perspective.

The two series diverge in 2000, with the national series running up 85% to the Cleveland series 23%, the declines are actually reasonably close though with the national rate dropping by ~ 27% peak to trough and the Cleveland series dropping ~22%. From that perspective the national average had a larger run up and decline, however from another perspective Cleveland lost all of its post 2000 gains with its index dropping back to 1999 levels, while the national average pushed back to only around 2003. The rebound has also been dramatically in the National averages favor with the 2006 peak being matched in 2016 and a steady rise after that while Cleveland only recently matched its 2006 peak.

The other perspective is then that without the housing bubble Cleveland's home prices would have been flat or falling while the national average would have been rising, albeit more slowly and that the impact on Cleveland was larger because the difference between a rising and falling market is much greater than the difference between a rising market and a market that rises at a higher rate.

*****************

I like thinking about different ways you can explain the yield curve, one way is to use the Cleveland perspective. That is the difference between getting a 30 year bond at X rate or a 20 year bond at a slightly higher rate is small compared to getting out of equities during a rise and getting out of equities during a fall. If you are jumping out of the way of a steamroller it doesn't matter much if you jump into a bramble patch, even though that bramble patch is far inferior to a manicured lawn because 99.9% of your desire is simply not getting crushed.

Monday, June 3, 2019

Monday, April 29, 2019

Short UNH

Puts bought on UNH again, still feel good about my general thesis and am just trying to pick good times to go short.

Thursday, April 18, 2019

Wednesday, April 17, 2019

Closed UNH, 3/4ths of HQY

Closed out my first position posted here, put on UNH up ~280%, and UNH up ~105%, and a position I took this morning which was a put on abmd.

Selling here because I find myself frozen, unable to think of what to do next. This is an unhealthy mindset that I am familiar with from playing poker years ago, better to step back, collect thoughts and then proceed. Buying a put on abmd worked out, but I bought because I didn't want to watch a big move down right after I sold out of half my exposure, basically it was emotional and shortsighted, which probably will lead to other similarly based decisions.

To state/restate my investing theory in bullet form.

1. The yield curve inversion is an inflection point. Approaching the inversion is a different investing environment than the period during the reversion and widening of the curve, companies and industries that do well in one probably won't do as well in the other.

2. The curve takes a long time to narrow, long enough for the 1st effect to have knock off effects on the economy. If housing booms from the environment then eventually construction firms will boom and then logging, reits, and realtors etc will boom. The early stages of the boom are when the first sectors take off, the height of the boom is when all the sectors are growing and the early stage of the bust is when the leading sectors have lost their growth but it has not yet hit the secondary sectors.

Clearly I picked the health care industry (as in stock prices within) as benefiting from the previous circumstances and the movement of prices recently has been a point in favor of my hypothesis. Now I need to move forward on projecting the timing and depth of the pullbacks and also anticipating the first order knock off effects, not staring at prices willing them to go down further.

Selling here because I find myself frozen, unable to think of what to do next. This is an unhealthy mindset that I am familiar with from playing poker years ago, better to step back, collect thoughts and then proceed. Buying a put on abmd worked out, but I bought because I didn't want to watch a big move down right after I sold out of half my exposure, basically it was emotional and shortsighted, which probably will lead to other similarly based decisions.

To state/restate my investing theory in bullet form.

1. The yield curve inversion is an inflection point. Approaching the inversion is a different investing environment than the period during the reversion and widening of the curve, companies and industries that do well in one probably won't do as well in the other.

2. The curve takes a long time to narrow, long enough for the 1st effect to have knock off effects on the economy. If housing booms from the environment then eventually construction firms will boom and then logging, reits, and realtors etc will boom. The early stages of the boom are when the first sectors take off, the height of the boom is when all the sectors are growing and the early stage of the bust is when the leading sectors have lost their growth but it has not yet hit the secondary sectors.

Clearly I picked the health care industry (as in stock prices within) as benefiting from the previous circumstances and the movement of prices recently has been a point in favor of my hypothesis. Now I need to move forward on projecting the timing and depth of the pullbacks and also anticipating the first order knock off effects, not staring at prices willing them to go down further.

Friday, March 22, 2019

Another position

Short HQY (financial/healthcare stock). Big move down today with the curve inversion steepening along with UNH having a moderate down day. I put a tiny position in on this a few weeks ago, this one is larger.

Monday, February 4, 2019

Why Healthcare

Previously I discussed why I think bubbles occur in the US but I left out why I took the position I did, and I was asked so the answer is:

I asked the market. Starting from the assumptions that I layed out the conclusion is fairly straightforward. The bubble sector* would be one that has grown much faster than the surrounding economy and then showed strong signs of a peak just as the yield curve started to invert. There were a few other check marks that it would need to have, such as increased demand or government meddling recently to explain why they were the sector that the money flowed into, but those were obvious for healthcare once I found that the other two patterns fit.

As for individual companies I went through and chose one whose growth appeared to have benefited the most from this situation (stock price wise).

*There doesn't have to be just one.

I asked the market. Starting from the assumptions that I layed out the conclusion is fairly straightforward. The bubble sector* would be one that has grown much faster than the surrounding economy and then showed strong signs of a peak just as the yield curve started to invert. There were a few other check marks that it would need to have, such as increased demand or government meddling recently to explain why they were the sector that the money flowed into, but those were obvious for healthcare once I found that the other two patterns fit.

As for individual companies I went through and chose one whose growth appeared to have benefited the most from this situation (stock price wise).

*There doesn't have to be just one.

Monday, January 28, 2019

First Move

I posted my first trade based on the ideas that I have been (slowly outlining above), I am listing my general positions here (but not the specifics) for tracking purposes (yours and mine). Today I went short (via puts) on United Health Groups stock (UNH ticker). This is not financial advice, this is simply my position and my reasoning. My actual advice is don't take financial advice from random people on the internet. A little bit of my positional reasoning to follow.

My current thoughts on how bubbles are created in the US is functionally a Cantillon feedback loop (for lack of a better term). As the Fed expands the money supply in the aftermath of a recession there will be some sector of the economy that is situated to benefit from this more than the others. One possible reason for why an industry would have greater profit potential would be a recent shifting of regulations meaning there is a new profit space to be explored and the means to do it. Three factors then compliment each other to push up the desirability of investing in the sector. First is the higher profit potential, the second is that there are underused resources in the economy as it comes out of recession, and third you have the Cantillon effects. Money naturally flows faster towards areas where there is more profit potential and so any new money* that enters the system is more beneficial to these sectors than other ones, and the sector gets first crack at the unused resources.

This gives you the initial growth period, but it also allows you to overshoot the "natural" total growth that an industry would see. Each new dollar that is created disproportionately benefits the particular sector and so the sector has an outside boost for as long as the Fed is loosening. From my point of view the Fed is functionally loosening until the Yield Curve starts to invert. The curve inversion strongly coincides with the early signs of issues within the bubble. The 2006 inversion was just before the sudden decline in new housing starts and the 2000 inversion was just before the sudden decline in the NASDAQ.

This general explanation has two advantages over other discussions of the Yield Curve that I have seen. It can be used to explain why the recession typically starts 6-8 quarters after the inversion and it can explain why the bubble does not reflate when rates are cut. The latter point is often ignored, as the Fed was cutting interest rates in July of 2007 and in November of 2000, both ahead of the beginning of the recession.

*using the term loosely here

Subscribe to:

Posts (Atom)