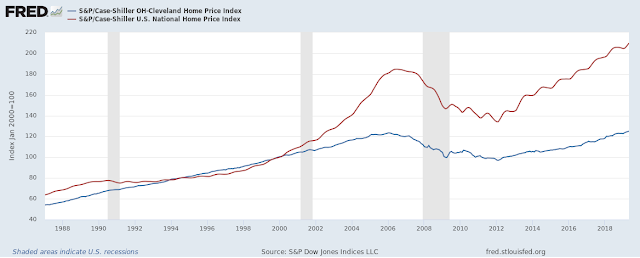

The two series diverge in 2000, with the national series running up 85% to the Cleveland series 23%, the declines are actually reasonably close though with the national rate dropping by ~ 27% peak to trough and the Cleveland series dropping ~22%. From that perspective the national average had a larger run up and decline, however from another perspective Cleveland lost all of its post 2000 gains with its index dropping back to 1999 levels, while the national average pushed back to only around 2003. The rebound has also been dramatically in the National averages favor with the 2006 peak being matched in 2016 and a steady rise after that while Cleveland only recently matched its 2006 peak.

The other perspective is then that without the housing bubble Cleveland's home prices would have been flat or falling while the national average would have been rising, albeit more slowly and that the impact on Cleveland was larger because the difference between a rising and falling market is much greater than the difference between a rising market and a market that rises at a higher rate.

*****************

I like thinking about different ways you can explain the yield curve, one way is to use the Cleveland perspective. That is the difference between getting a 30 year bond at X rate or a 20 year bond at a slightly higher rate is small compared to getting out of equities during a rise and getting out of equities during a fall. If you are jumping out of the way of a steamroller it doesn't matter much if you jump into a bramble patch, even though that bramble patch is far inferior to a manicured lawn because 99.9% of your desire is simply not getting crushed.

No comments:

Post a Comment